HELPING FINTECH VENDORS EXECUTE GROWTH STRATEGIES

But the results are not repeatable, scalable, and profitable.

Growth Strategy Execution for

Financial Technology Vendors

Too Many Great Strategies Are Wasted On Poor Execution

What we do

We know the source of growth challenges & the best-practices to overcome them

Fintech Growth Challenges

Fintech Growth Challenges

Growth Strategy Blueprinting™

Growth Strategy Blueprinting™

Who we help

We enable fintech vendors

to realize their growth strategies

FINASTRA

NICE

FISERV

TRANSACTIS

ACI WORLDWIDE

BRIDGEFORCE DATA SOLUTIONS

What we believe

Strategy execution has fundamental flaws

The Methods

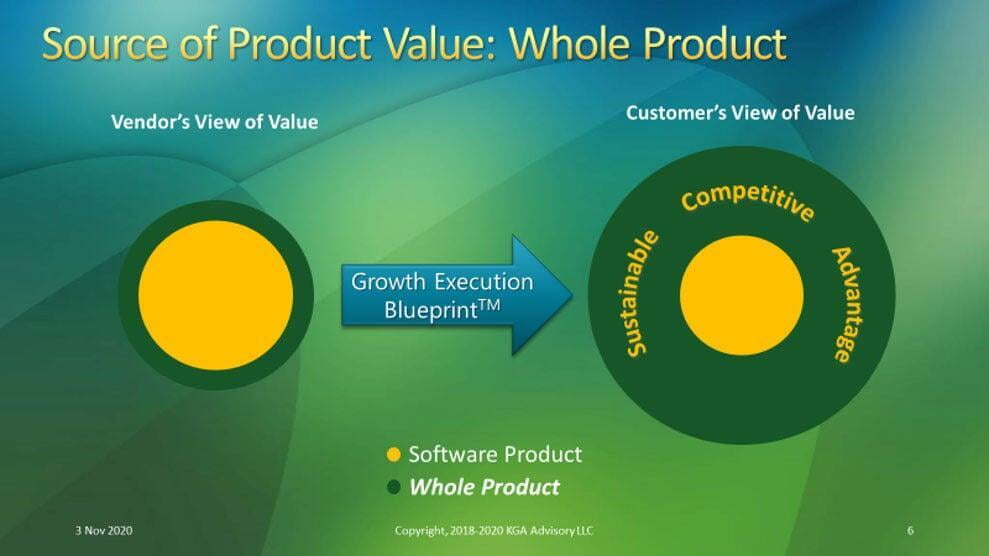

The Whole-Product Value

Most fintechs mistakenly believe that the buyer gets most of the value from the software (the left circle). In fact, the buyer gets more value from the rest of the vendor’s business model – the “Whole-Product” – that touches the customer (the right circle). This includes touchpoints like partnerships, client onboarding, product packaging & integration, customer support, and security & privacy, to name a few.

Simply put, if the fintech is easy to do business with during the life of the relationship, then:

- the value of the solution will increase

- there will be less price pressure, and

- you will sustain a competitive advantage

We have been the fintech vendor executive

frustrated with failed growth strategies

KGA Engagement First Principles

It’s about the buyer, not the vendor

Before execution

Always bring methods, best practices, and tools

Do the heavy lifting (never show up with a clean sheet of paper)

End with the improvement plan, including change management

In a 30-minute conversation, we will diagnose your struggles and document improvements.