FINTECH VENDOR GROWTH CHALLENGES

Too many great strategies are wasted on poor execution.

Fintech Growth Challenges

Too many great strategies are wasted on poor execution.

What Do Growth Struggles Look Like?

Fintechs With Challenges

Fintechs like KGA clients (both global incumbents and emerging) sell mission-critical solutions to banks, billers, lenders, merchants, and processors. Those applications include wholesale payments, fraud prevention, anti-money laundering, online banking and billpay, collections, biller billpay, card issuing, merchant processing, lending, credit reporting, and more.

Root Causes of Poor Growth-Strategy Execution

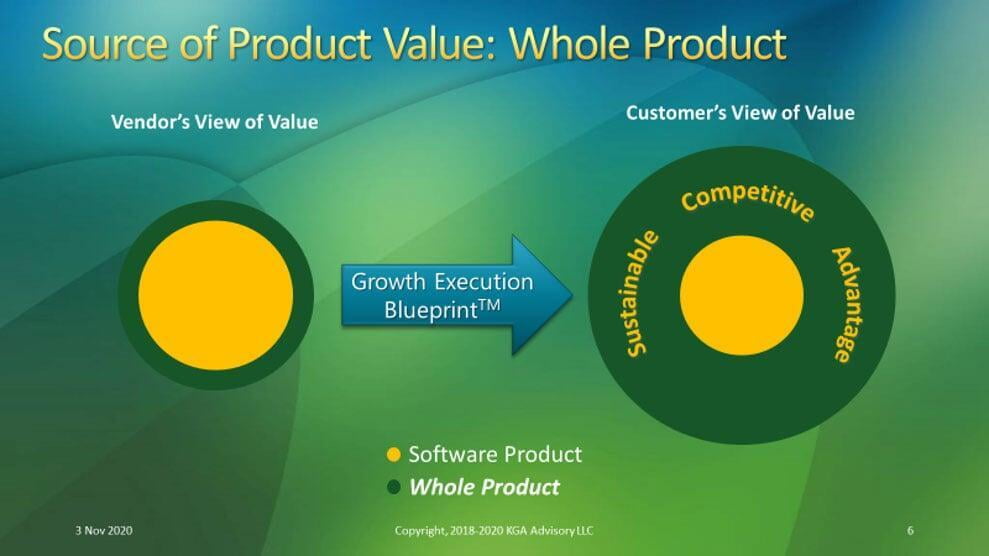

Most financial technology providers (incumbent & emerging) mistakenly believe that the buyer gets most of the value from the software (the left circle). In fact, the buyer gets more value from the rest of the vendor’s operating model – the “whole-product” – that touches the customer (the right circle).

Simply put, if you and your solution are easy to do business with during the life of the relationship, then:

- the value of the solution will increase

- there will be less price pressure, and

- you will sustain a competitive advantage

What Are the 2 Causes of Growth Execution Challenges?

Too little focus on the buyer

- Should the solution package include Feature A or B?

- Do we need 24X7 or 8X5 customer support?

- Should the uptime SLAs be three or four 9s?

Too much focus on the software

Financial technology buyer needs go well beyond the software product. Clients care about business model details like contract terms, onboarding, product packaging, customer support, innovation programs, and the rest of the client touchpoints in the graphic at the left. These details must be designed-into the solution for a market-full of buyers so that the business is repeatable, scalable, and profitable.

Risky Approaches

Once the fintech’s growth strategy is formulated, many of our clients turn to Strategy Execution initiatives. Examples of those include turning loose the salesforce, establishing partnerships, writing new software, establishing service levels, and many, many more. Fintechs pursue misguided impulses like: “let’s to sell a few, and figure the solution out later.” Turning to Strategy Execution too soon introduces risk and has consequences.

Consequences of Poor Growth Execution

Risky Approaches

Loss of Share

Unprofitable Growth

- custom solutions that will not scale

- a poor understanding of the solution’s cost structure